DIY MY FINANCES is a Personal CFO system: budgeting, planning, KPIs, and Ask Finn connected across your real financial data. No bank linking required.

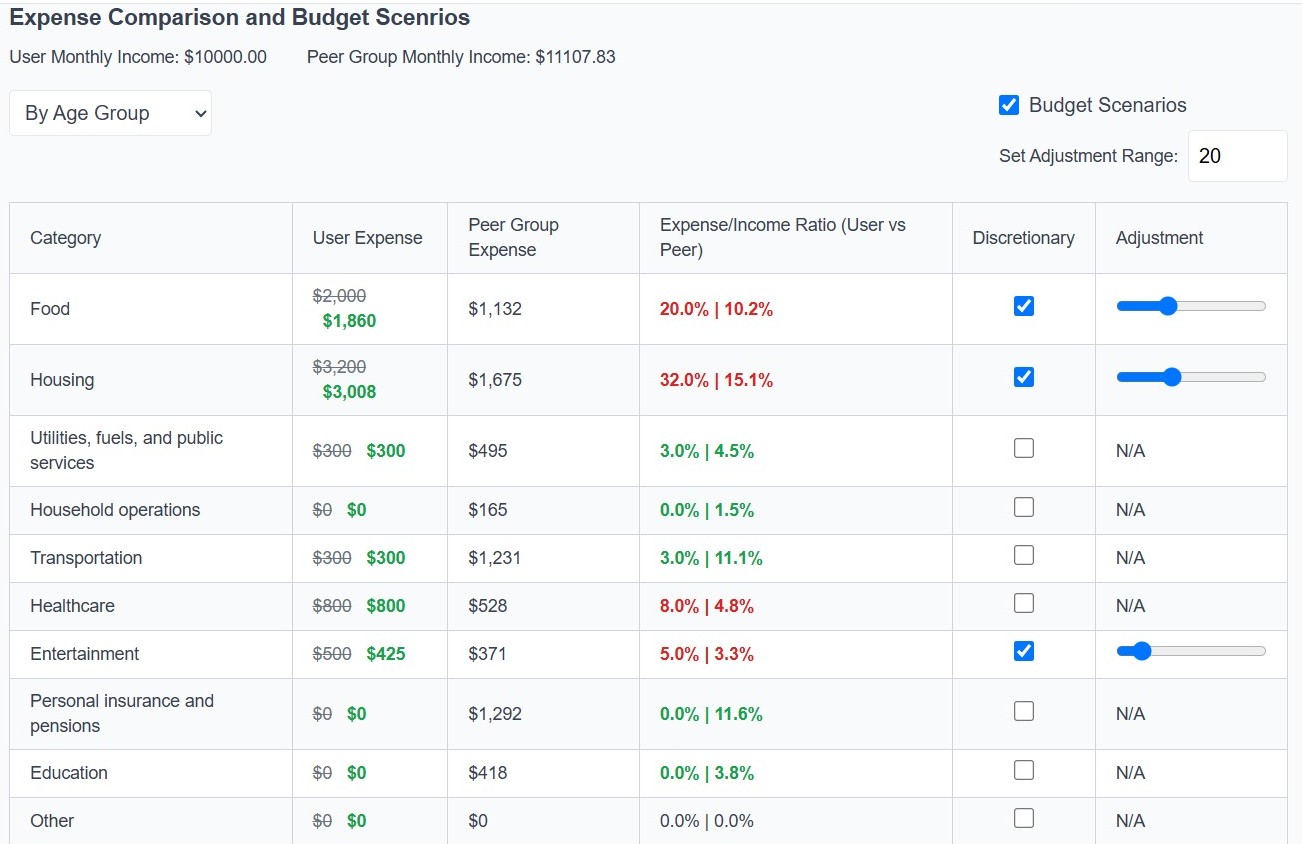

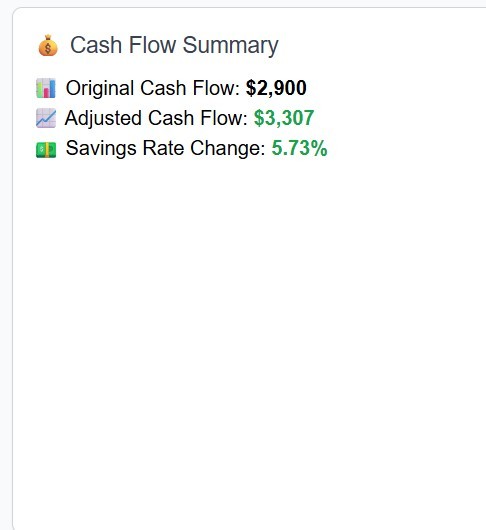

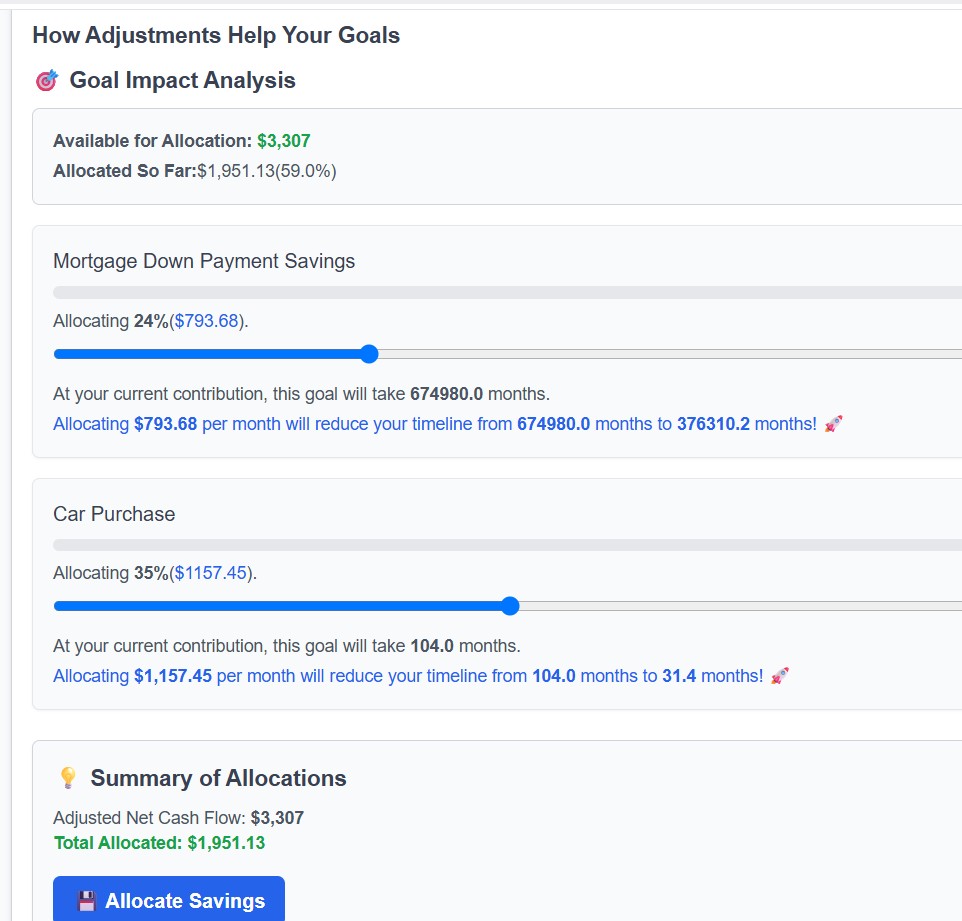

Explore budgeting dashboards, spending analytics, peer comparison, and goals—built to support smarter money decisions.

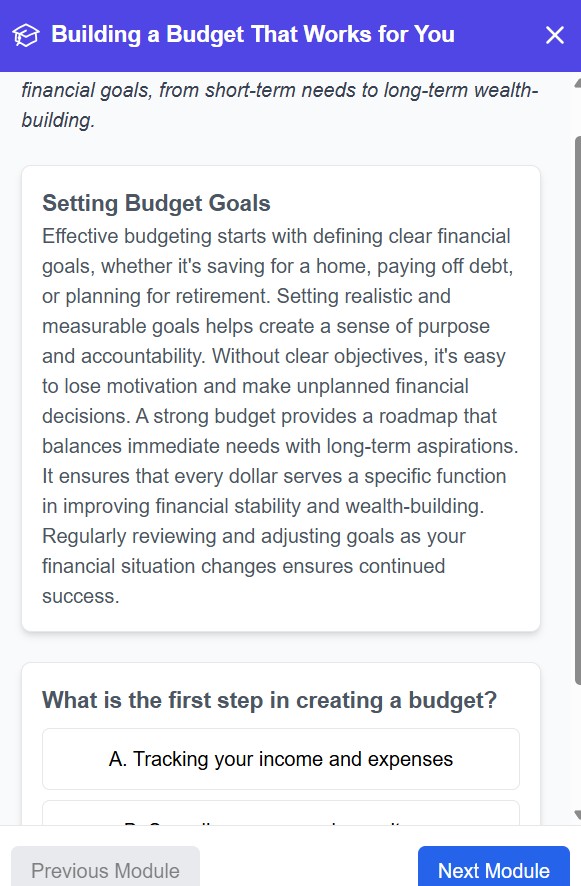

Get answers to common budgeting questions about privacy, planning, Ask Finn, and more.

Budget smarter, plan ahead, and ask Ask Finn—using your numbers.

Start Your Free Trial