Model your debt payoff plan—compare snowball vs. avalanche, run what-if scenarios, and discover the smartest path out of debt.

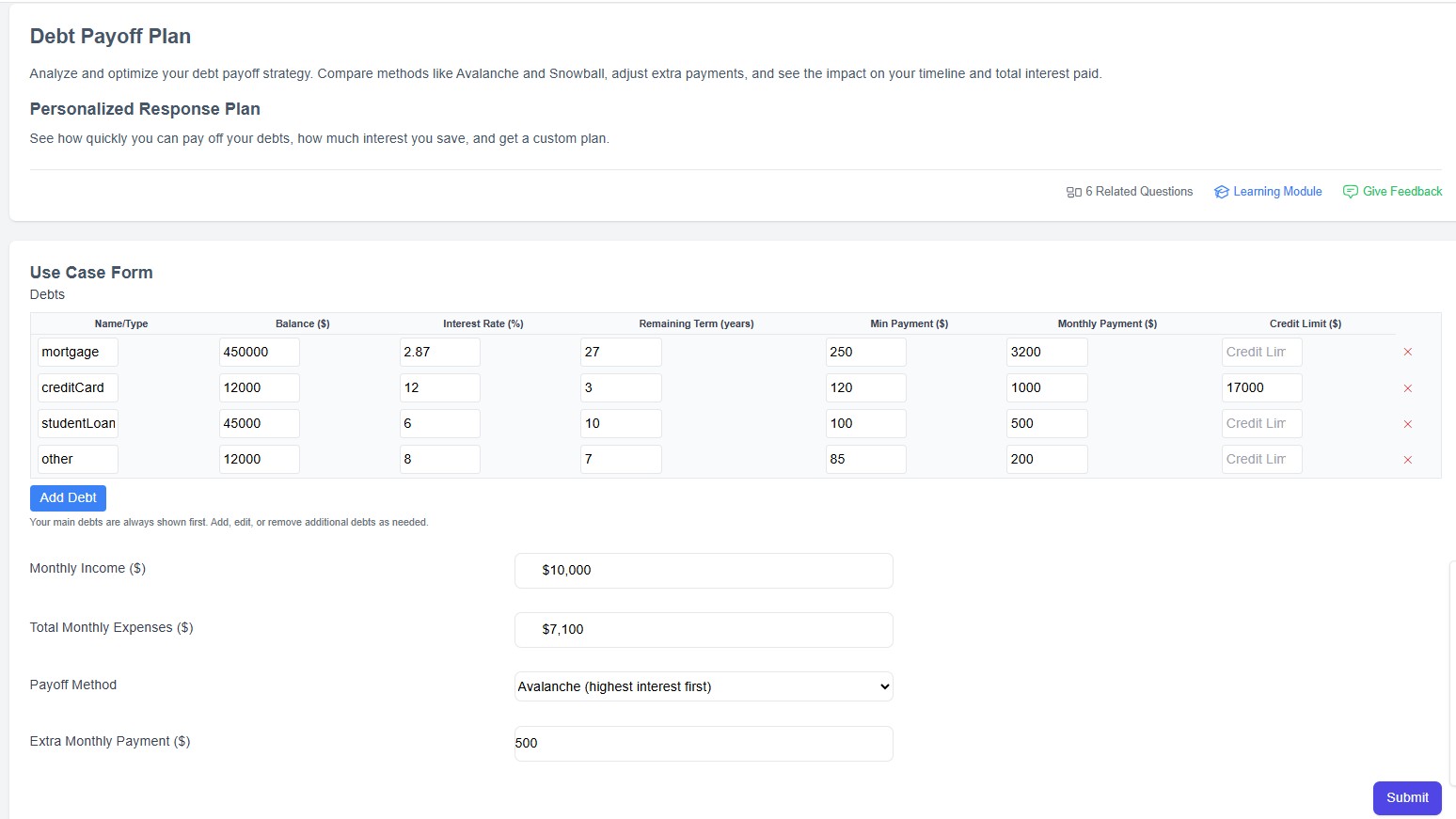

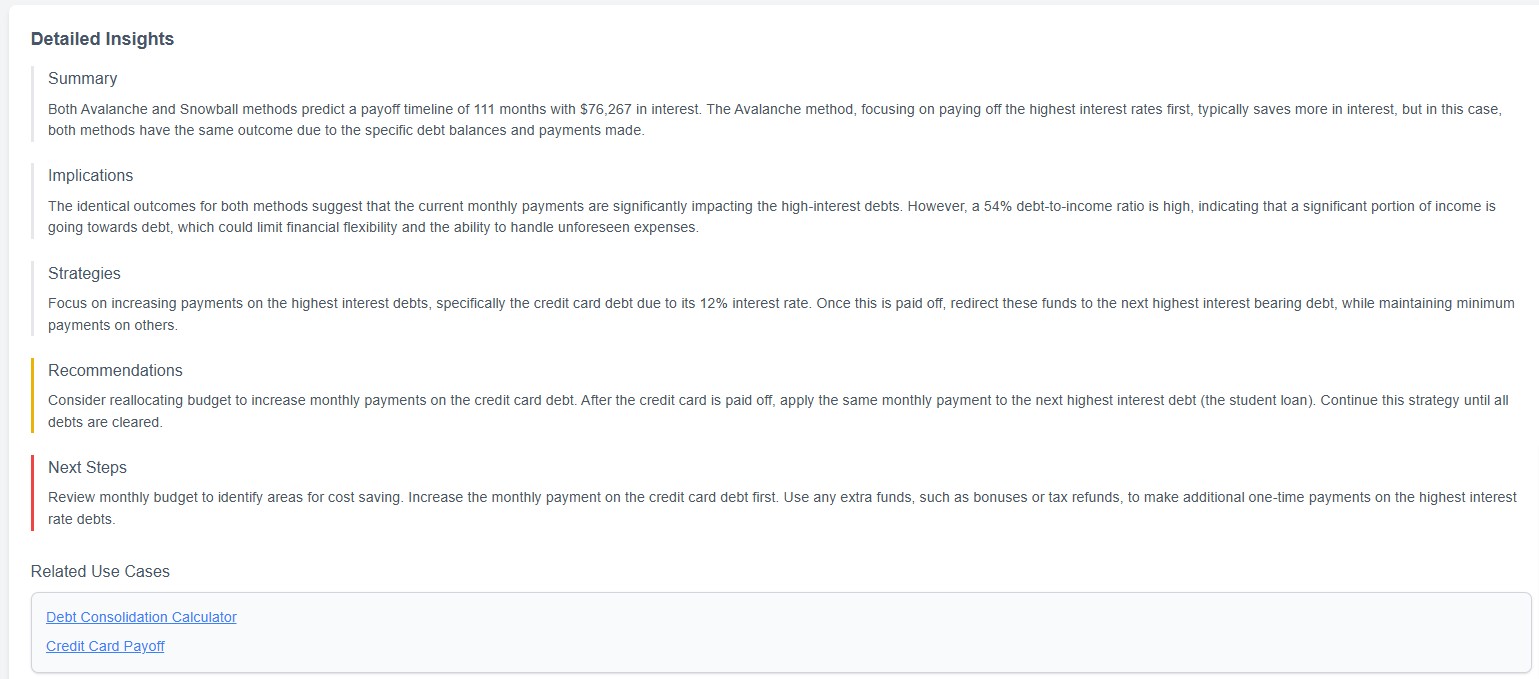

The best approach depends on your goals—debt snowball focuses on motivation by paying off the smallest balances first, while debt avalanche saves you the most in interest by targeting the highest rates first. Our tool lets you compare both and see the impact.

Even small extra payments can dramatically reduce your interest and time to debt freedom. Use our what-if scenario tool to see how much faster you can be debt-free.

DIY My Finances is privacy-first and does not require linking your bank accounts or sharing sensitive info. Your plan stays private.

Compare standard, accelerated, or refinancing options with our scenario tool. See the pros and cons of each, and get a plan that fits your life.

DIY My Finances combines privacy-first tech, flexible scenario planning, and personalized insights—no ads, no sales pitches, just results.