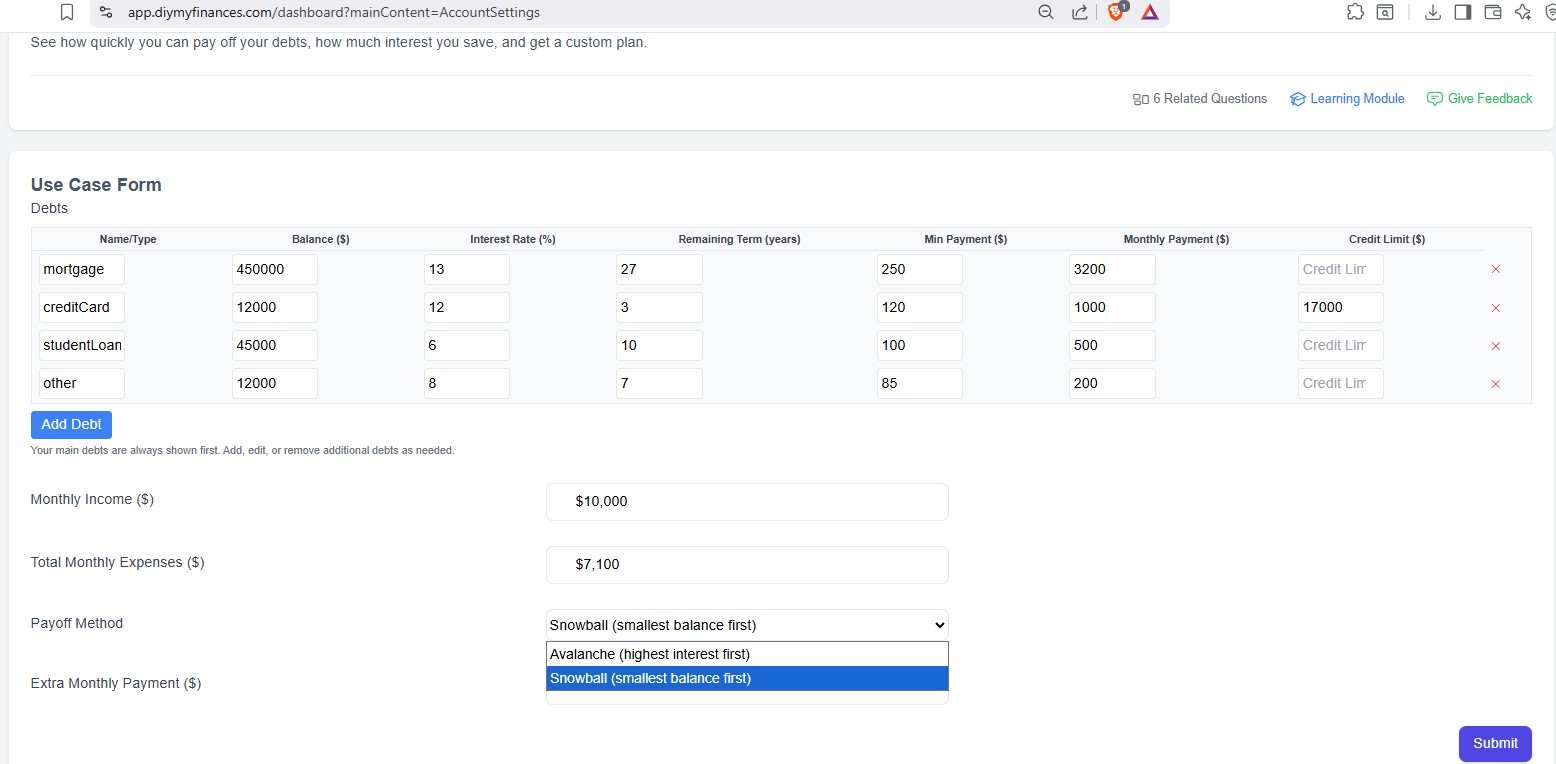

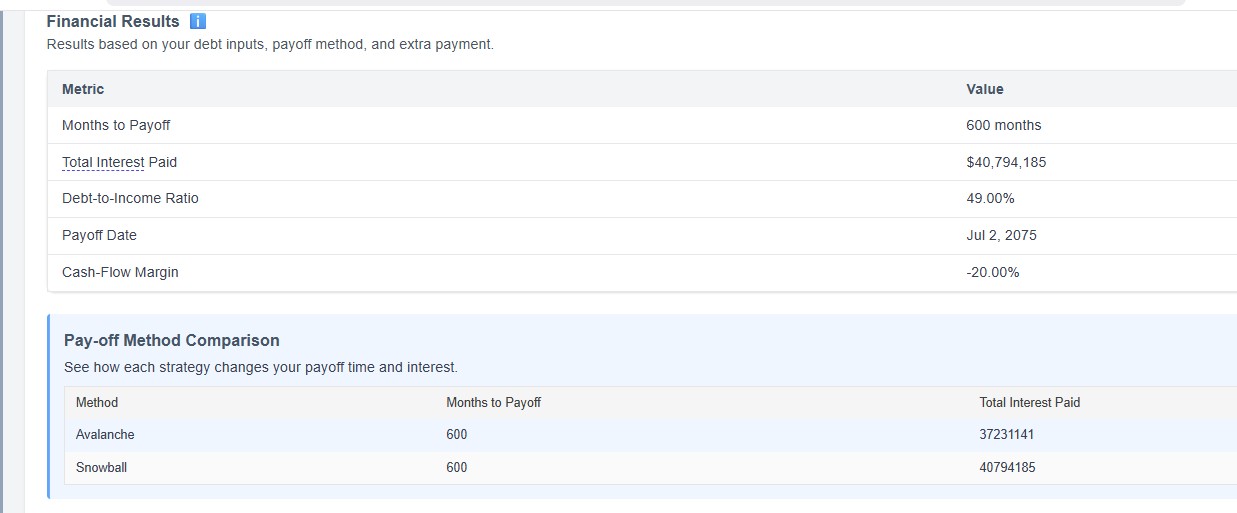

See which strategy pays off your debt faster and saves you more in interest.

Snowball is best for motivation, avalanche saves you the most money. Try both in our calculator to see your best fit.

Yes. You can switch at any time, or use a hybrid. Our scenario tool lets you test the impact instantly.

Never. DIY My Finances is privacy-first—just enter your debts and start modeling!