Most investors leave returns on the table by not optimizing their mix of stocks, bonds, real estate, and alternatives. The right portfolio allocation maximizes growth while managing risk, helping you reach your goals faster and more reliably.

Smart allocation helps grow your investments and cushion downturns.

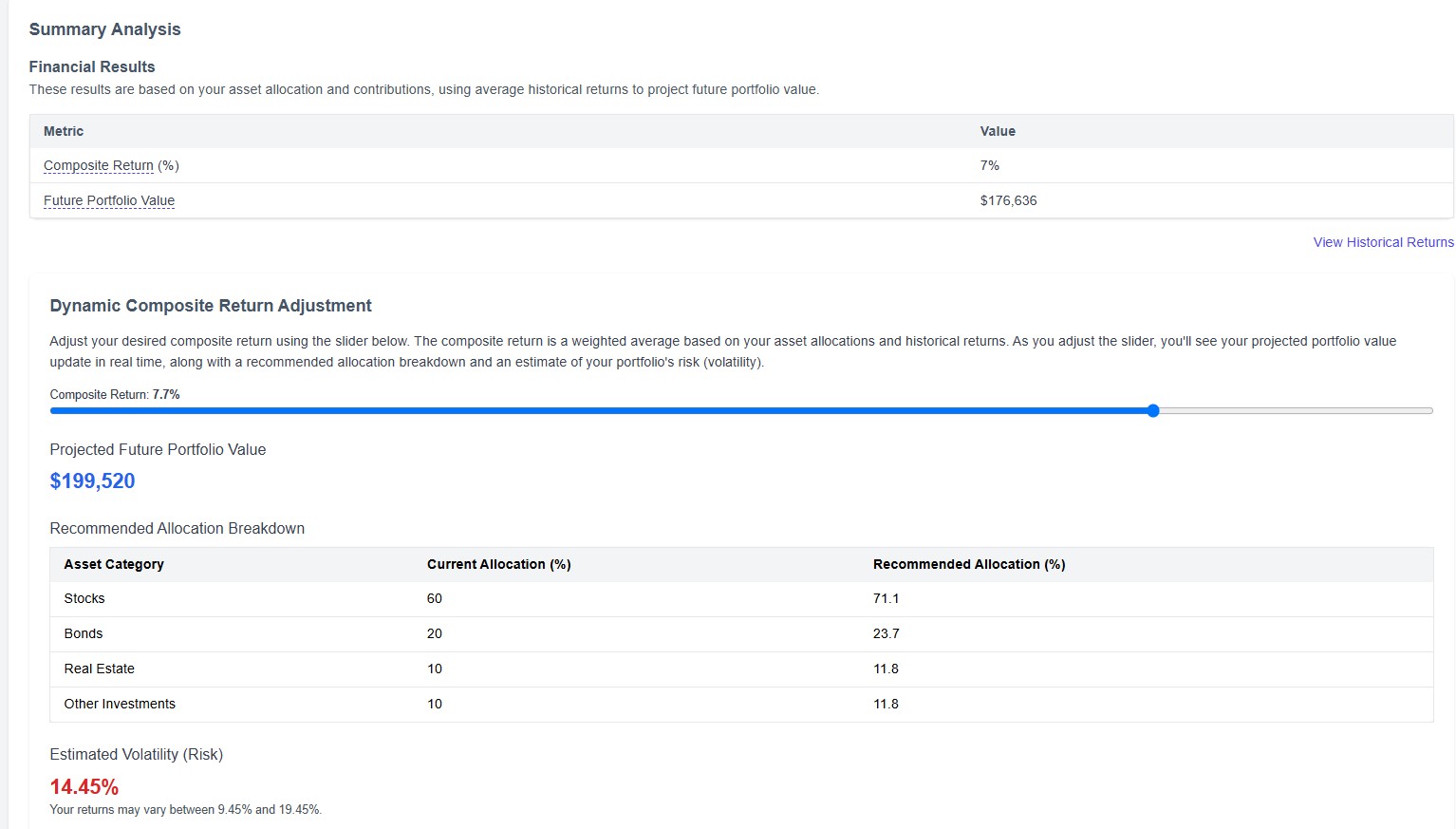

Visualize future value using real historical returns and dynamic simulations.

Align your asset mix to your risk comfort, stage of life, and goals.

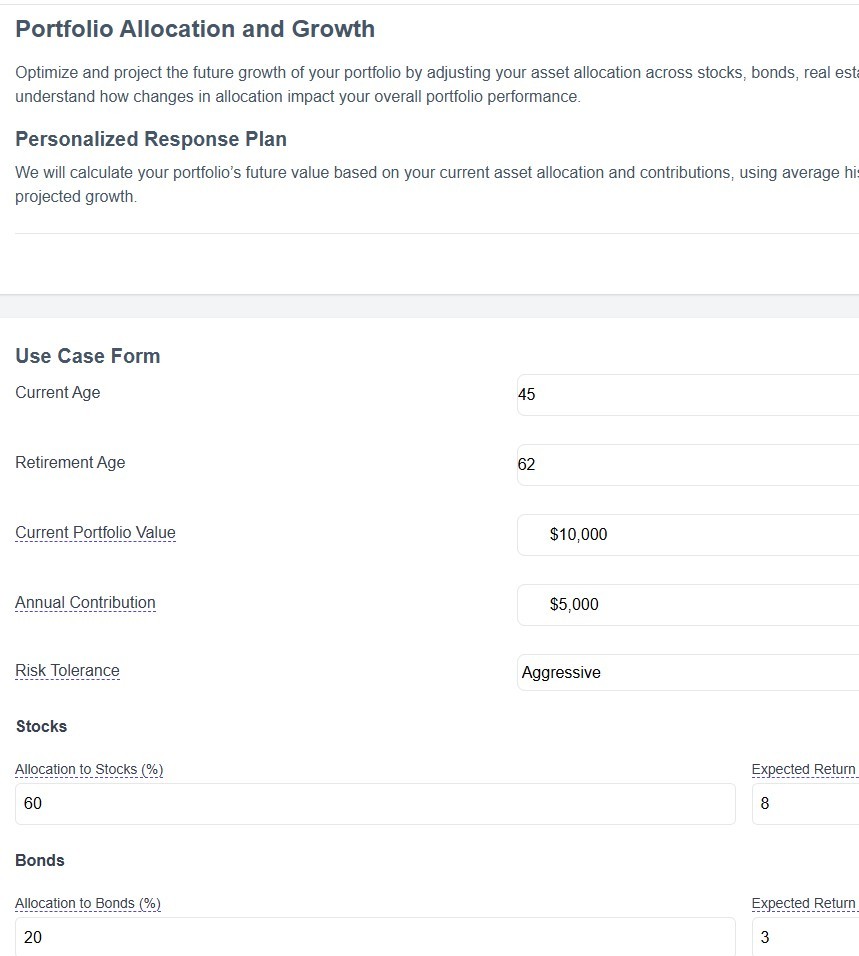

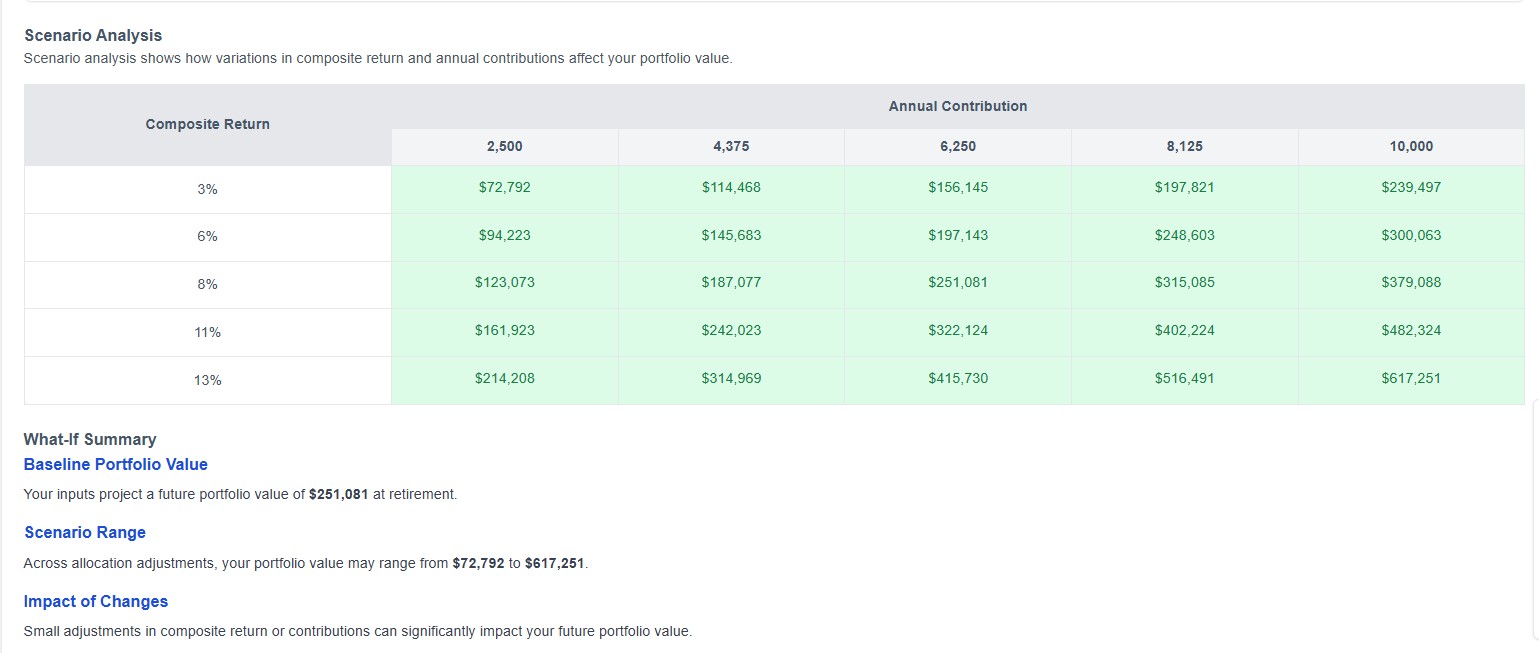

Model different asset mixes and instantly see the projected growth of your investment portfolio.

Calculate your portfolio's future value using historical returns and your real contributions.

See how changing allocation or contributions impacts your long-term wealth.

Select from aggressive, moderate, or conservative presets, or fully customize your own.

Compare your allocation and projected returns to others in your age and risk group.

Get advanced insights without connecting outside accounts. Your data stays yours.

Explore our intuitive investing dashboard, advanced portfolio allocation analysis, and privacy-first planning tools designed for smarter financial management and goal achievement.

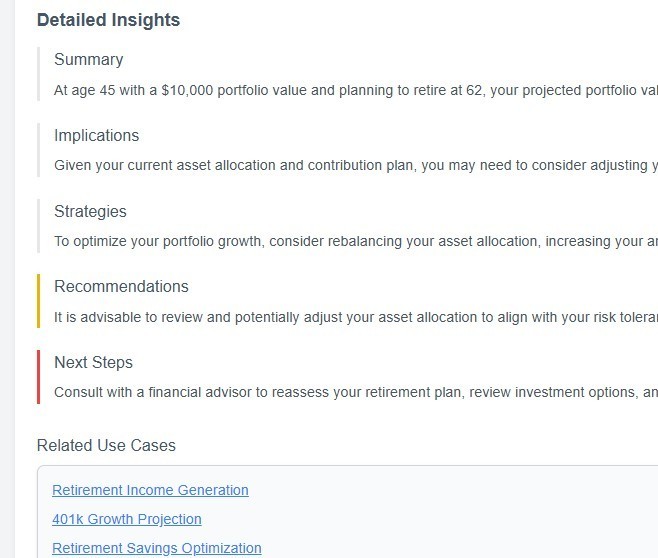

There's no single best mix. Use our tool to benchmark yourself and try model portfolios for conservative, moderate, or aggressive growth, or create your own allocation based on your goals and risk comfort.

Many investors review allocations annually or when markets shift significantly. Our simulator lets you explore results before making changes.

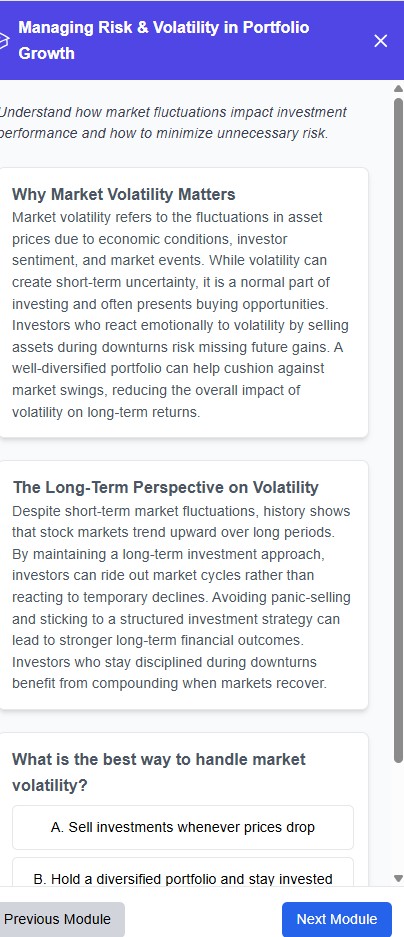

Absolutely! We designed our tools to be simple and educational, with helpful guides every step of the way.

Project your portfolio growth to retirement, run scenarios, and see how contributions or asset allocation tweaks can close your savings gap.

Try our portfolio allocation and growth simulator today.

Start Free Trial