Explore our early retirement calculator and dashboards—model your savings, test “what-if” scenarios, and see how small changes can speed up your financial independence.

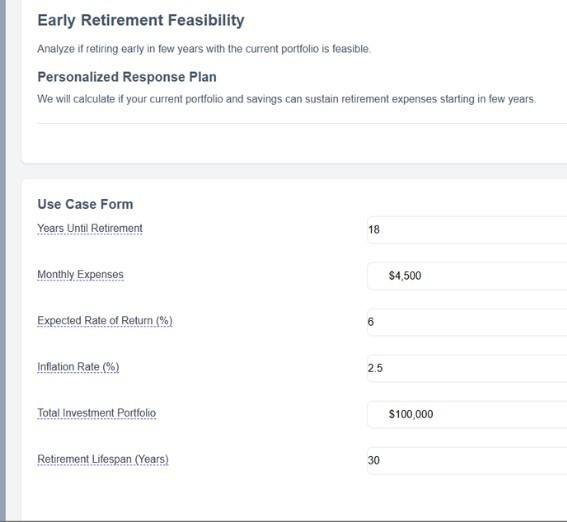

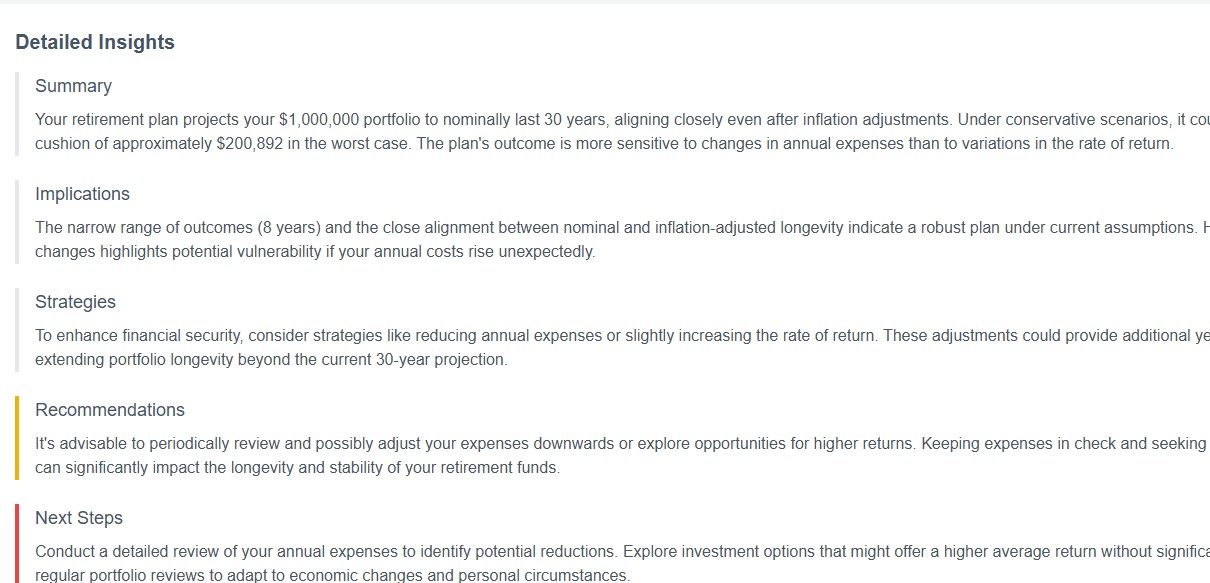

The exact amount depends on your annual spending, expected retirement age, and investment returns. Use our early retirement calculator to estimate your number, test different scenarios, and see how your savings rate affects your timeline.

Yes—if your savings and investments can cover your expected expenses until Social Security or other income kicks in. Enter your info in our early retirement scenario to see if you’re on track, or what you need to adjust to retire at 55, 50, or even earlier.

Your FIRE number is typically 25 times your annual expenses. Our calculator helps you refine this with your own data, including inflation, side income, and healthcare needs.

Starting late means you may need to save more aggressively or adjust your goals. Use the “what-if” analysis to model catch-up contributions, downsizing, or side hustles for faster results.

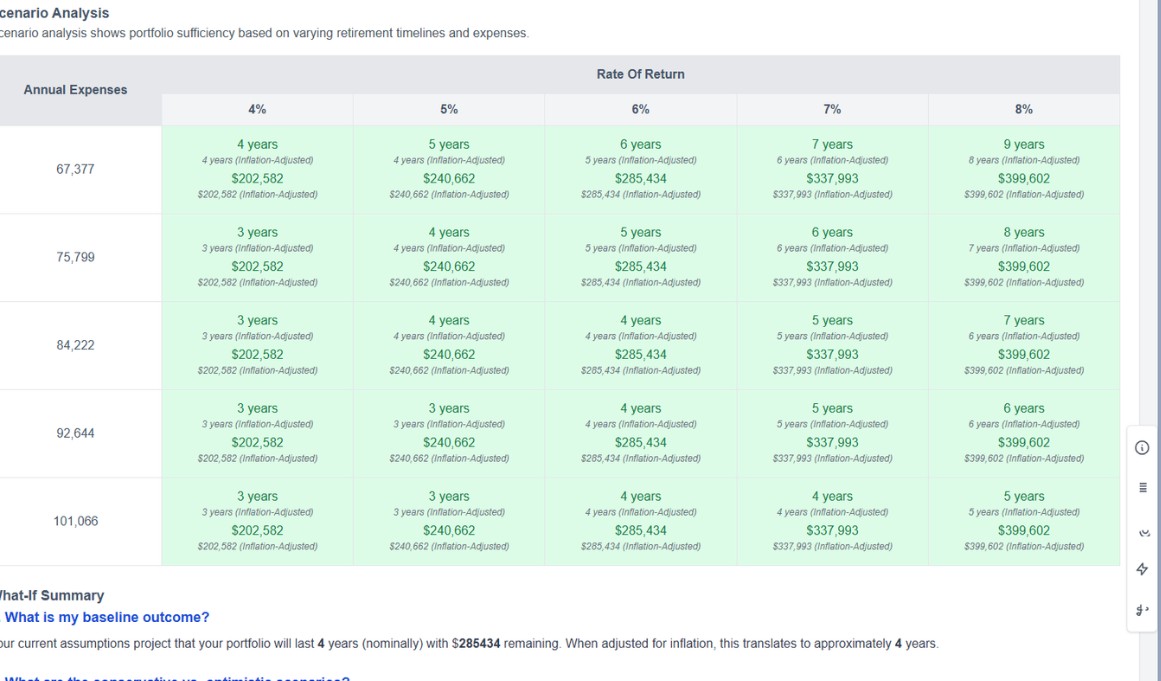

Both can significantly change your results. Our scenario tool lets you adjust these assumptions, so you can stress-test your plan for bull and bear markets and rising costs.

Yes. DIY My Finances is designed for self-directed retirement planning, with interactive calculators, peer benchmarks, and AI-powered insights—no advisor or sales pitch required.

We offer privacy-first, scenario-based planning, and let you model any “what-if” you want. Try it risk-free—no account connection or downloads needed.

A scenario-based retirement calculator lets you test different “what-if” cases for retiring early, such as changes to savings, spending, investment returns, or income. DIY My Finances is built to help you see the full impact of every choice.

Use our catch-up savings scenario to estimate the extra contributions needed, review your plan, and see how adjusting savings or reducing expenses affects your retirement age.

Yes—your data stays private, and no account linking or advisor is required. DIY My Finances puts you in full control of your retirement planning, securely and anonymously.