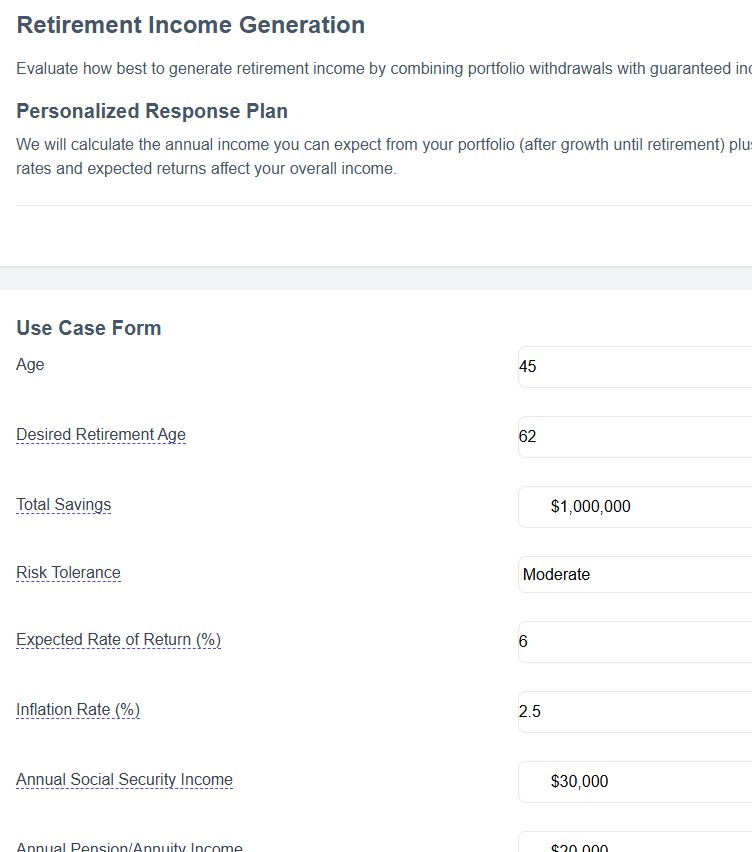

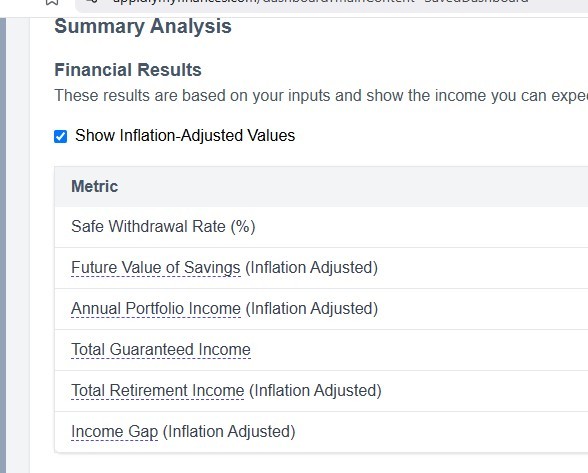

Compare portfolio withdrawals, Social Security, pensions, and guaranteed income—see how your choices impact your retirement paycheck.

The best retirement income strategies combine withdrawals from savings, Social Security, pensions, annuities, and investment income. Diversifying your sources can provide stability and peace of mind.

Balance growth, risk, and guaranteed income by adjusting your asset allocation. Our tool helps you test scenarios and find the right mix for your needs.

Yes! Combining these sources can smooth your income and reduce risk. Model different start dates and withdrawal rates to maximize your paycheck.

Annuities can provide guaranteed lifetime income. Use our scenario tool to see how they fit your overall plan and compare to other sources.

Taxes can reduce your net income. Test different withdrawal and income strategies in our planner to optimize after-tax results.

Yes—DIY My Finances gives you AI-powered, scenario-based insights for your unique situation. See what works best for your risk tolerance and lifestyle.

No. Our planner is privacy-first and requires no account linking, downloads, or advisor sales pitch. You stay in control, always.