Track your retirement savings, model catch-up strategies, and visualize your future—no advisor or downloads needed.

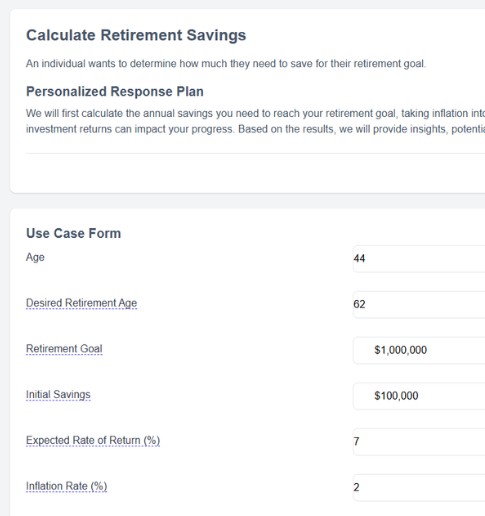

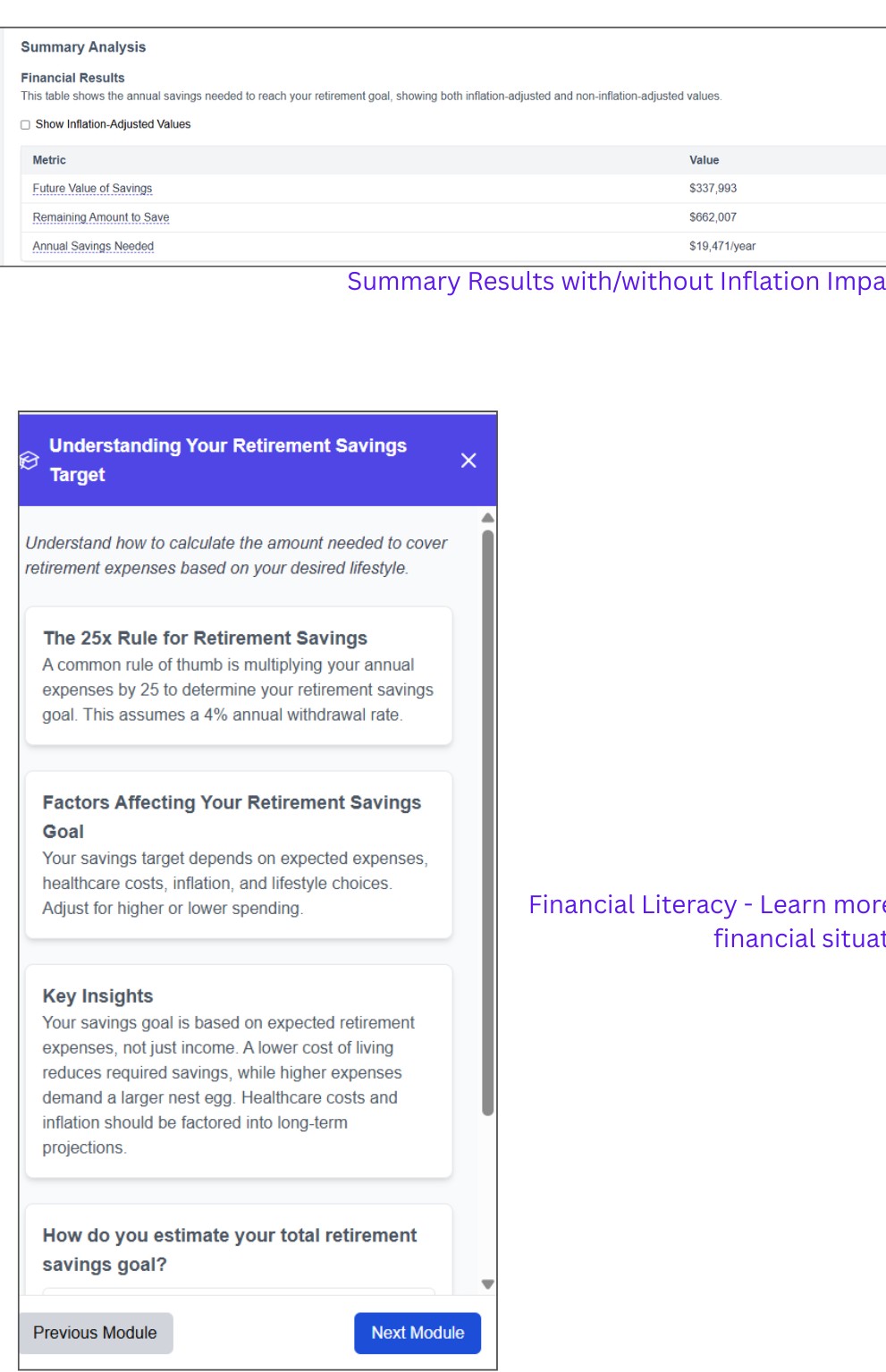

The amount depends on your income, age, expenses, and desired retirement age. Use our retirement savings calculator to set a target, test different scenarios, and plan your path.

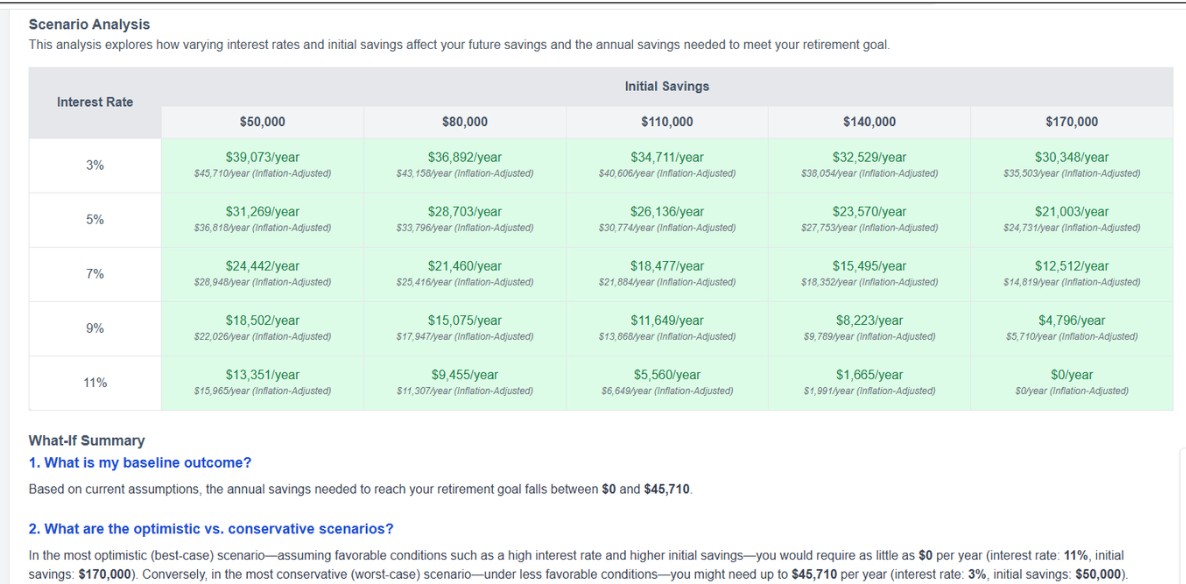

The best calculator lets you enter your own info, run what-if scenarios, and adjust for inflation, growth, and expenses. DIY My Finances is scenario-based and privacy-first.

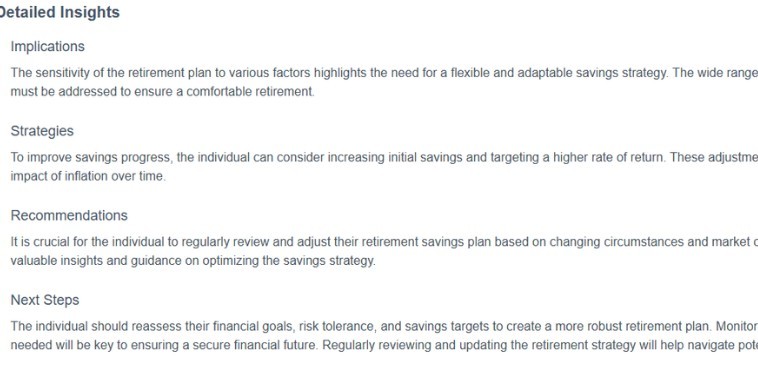

Yes! Our catch-up analysis lets you model higher contributions, delayed retirement, or reduced expenses—see exactly what changes can close your savings gap.

DIY My Finances benchmarks your plan against peers by age and income, so you can see where you stand and what steps can help you improve.

Yes—our tool requires no advisor, no downloads, and no account linking. Your data stays private and secure.

Savings calculators help you reach a goal amount; income calculators help you draw down assets sustainably in retirement. DIY My Finances lets you run both, so you see the full picture.

Our calculator models inflation so you can see the real purchasing power of your savings and adjust your plan as needed.