Test different withdrawal rates—see how spending, inflation, and investment growth affect the sustainability of your retirement income.

A safe withdrawal rate is the annual amount you can withdraw from your savings without running out of money. Many experts suggest 4%, but the right rate for you depends on your age, savings, expenses, and market returns. Our tool helps you test multiple rates.

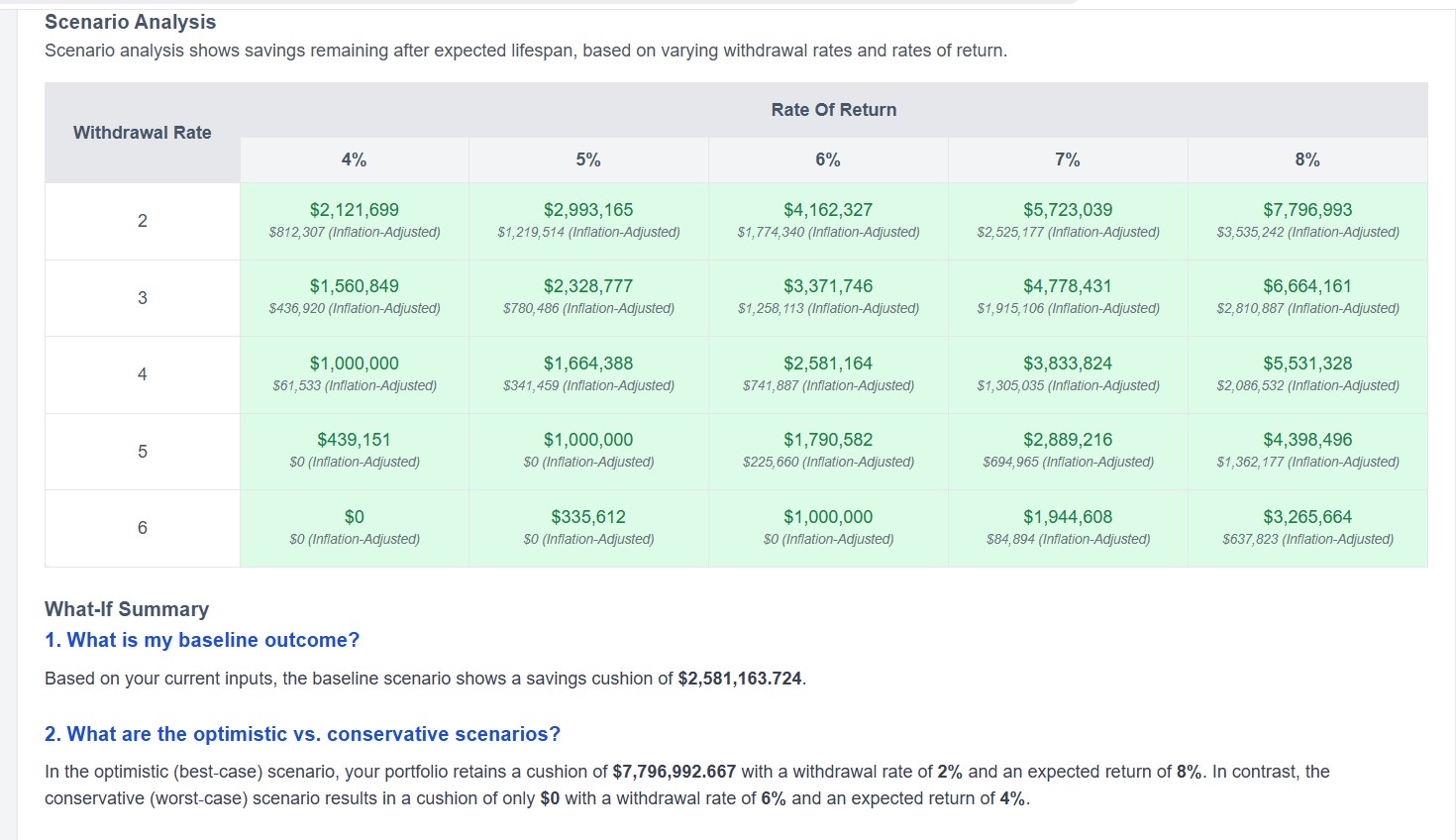

Higher withdrawal rates mean your savings may not last as long—especially if markets dip or inflation rises. Our calculator lets you model 3%, 4%, 5%, and 6% withdrawals and see how long your money will last in different scenarios.

Use our scenario-based planner to test different withdrawal rates, spending levels, and investment returns. Get AI-powered recommendations to optimize your plan for lasting security.

The 4% rule is a guideline for sustainable withdrawals, based on historical market returns. It’s a great starting point—but our tool helps you go deeper by customizing your own plan.

Yes! The best strategy depends on your asset allocation, age, retirement timeline, and goals. Model tax impacts, sequence-of-returns, and spending flexibility with our calculator.

No—DIY My Finances is privacy-first, scenario-based, and does not require account linking or an advisor. Get instant results and full control.